Life Insurance in and around Seminole

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

When facing the loss of a loved one or your spouse, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and try to move forward without your loved one.

Insurance that helps life's moments move on

What are you waiting for?

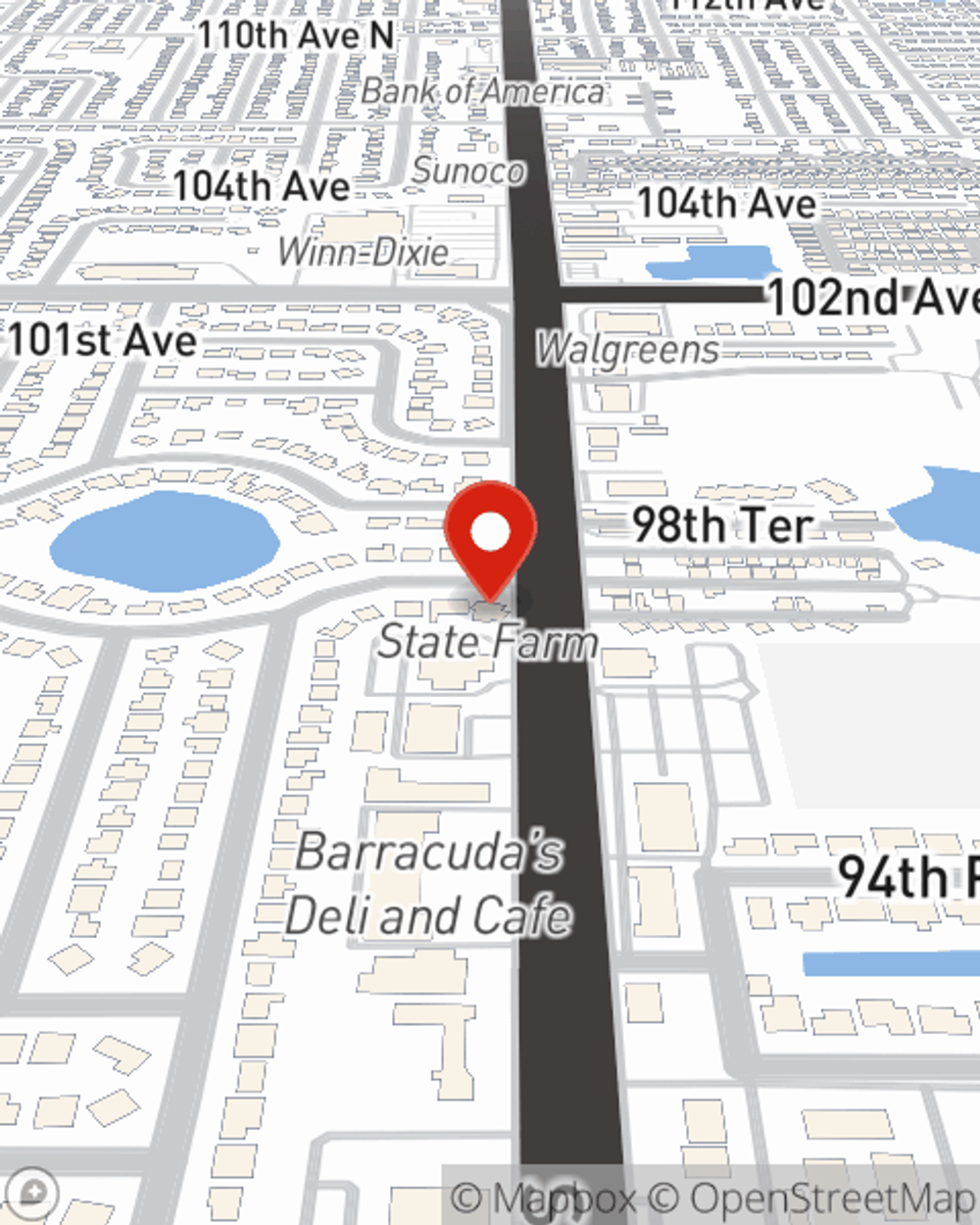

Why Seminole Chooses State Farm

Having the right life insurance coverage can help loss be a bit less debilitating for your loved ones and give time to recover. It can also help cover certain expenses like medical expenses, home repair costs and childcare costs.

Don’t let worries about your future make you unsettled. Contact State Farm Agent Tim Tran today and see how you can benefit from State Farm life insurance.

Have More Questions About Life Insurance?

Call Tim at (727) 391-0127 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.